salt tax cap expiration

One of these changes commonly referred to as the SALT cap limitation limits the amount of state and local taxes an individual can deduct on a personal income tax return. Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People Tax Policy Center

After tax year 2025 the.

-PB_Full_Hero_2880x1620-v01.jpg/_jcr_content/renditions/cq5dam.web.1200.630.jpg)

. Democrats have Republicans to thank for clearing the way for the budgeting tricks that will allow them to do. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. However the 2017 law capped state and local tax SALT deductions at 10000 for the 2018 through 2025 tax years making it less likely youll receive a full tax benefit for.

Tax Hikes in House Social Spending Bill Total 148 Trillion. While the Tax Cuts and Jobs Act placed a 10000 cap on the SALT deduction its only temporary. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state. What Is the State and Local Tax SALT Deduction.

House Democrats on Friday passed their 175 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes known as. The cap applies to taxable years 2018 through 2025. The tax cut would allegedly be offset.

The current SALT cap is scheduled to expire after 2025 which would allow for an. 53 rows The SALT deduction however will continue to be important for those who itemizewhich is to say for wealthier taxpayers If Congress does not make permanent. The deduction has a cap of 5000 if your filing status is married filing separately.

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue by about 75 billion between 2022 and 2025. Another proposal would increase the SALT cap to 15000 for single filers and 30000 for joint filers.

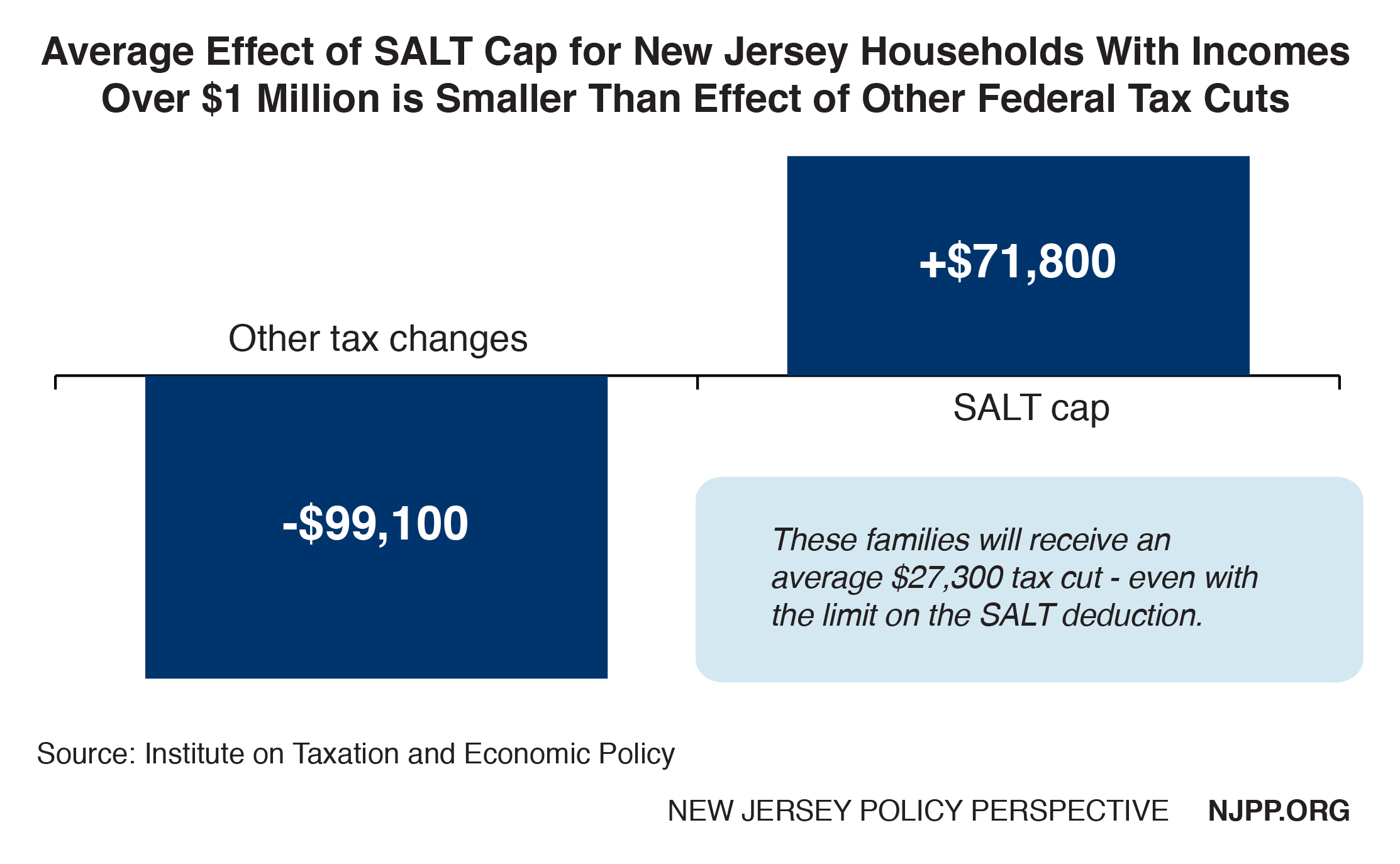

Under current law a taxpayer may deduct up to 10000 of any state and local taxes paid. The 2017 Tax Cuts and Jobs Act temporarily capped the deduction for aggregate state and local taxes including income and property taxes or sales taxes in lieu of income. In high-income high-tax states the SALT cap typically affects about.

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. Fortunately this limitation is only temporary. As alternatives to a full repeal of the cap lawmakers and.

This would reduce federal revenue by about 135 billion between 2022 and 2025. The Supreme Court Monday rejected an appeal from several states challenging Congresss cap on state and local taxes that can be deducted from federal taxable income. The cap is scheduled to expire in 2025 along with the laws other individual income-tax provisions.

Salt Cap Workarounds Will They Work Accounting Today

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Report Archives Page 8 Of 11 New Jersey Policy Perspective

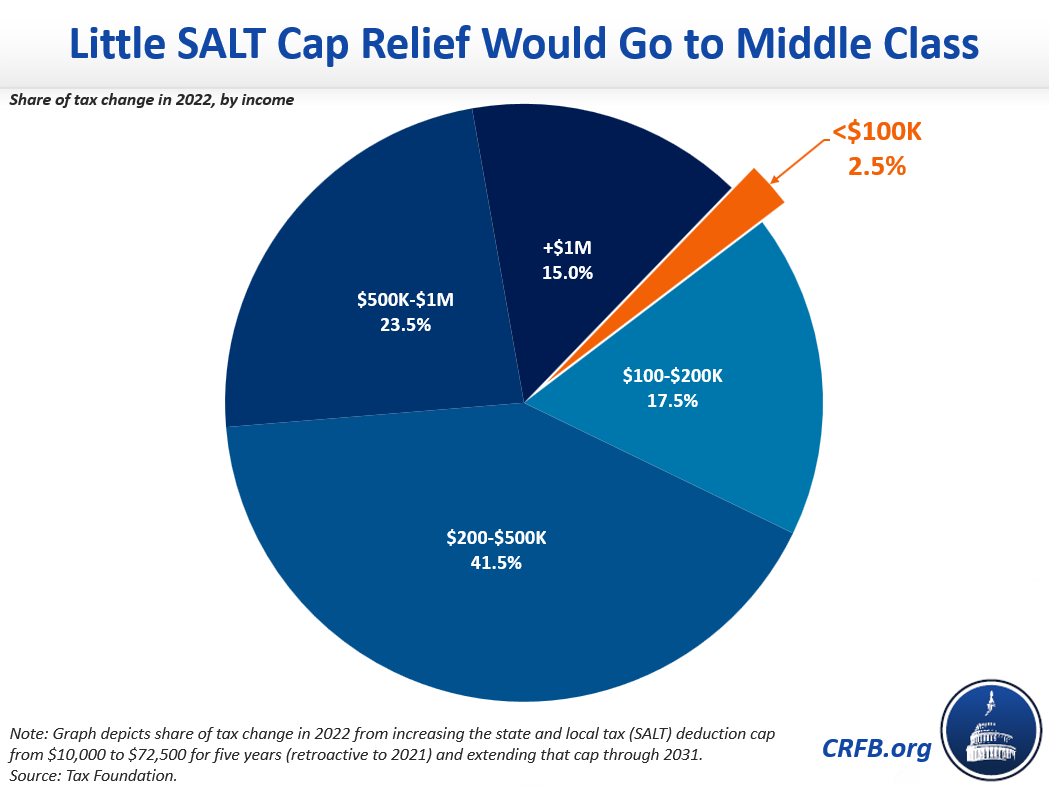

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

Congress And The Salt Deduction The Cpa Journal

Nj House Delegation Calls For Elimination Of Salt Tax Hike

State And Local Tax Salt Deduction Salt Deduction Taxedu

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Lawmakers Who Ran On Salt Relief Prepare To Face Voters Roll Call

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Supreme Court Won T Hear Case On Limit To State And Local Tax Deductions The New York Times